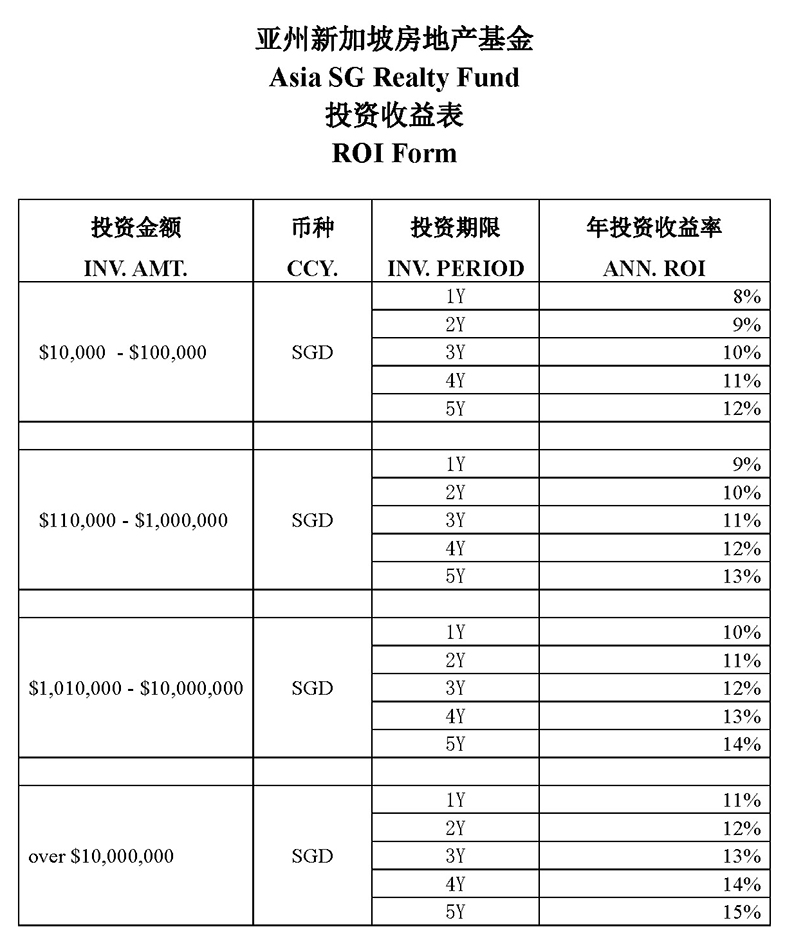

1.Annual Investment Yeild in Asia SG Realty Fund:

1-1. A one-time investment of SD $10,000 -SD $100,000

1-year investment period, the interest will be paid at maturity with 8% annual investment yeild.

2-year investment period, the interest will be paid at the end of each year with 9% annual investment yeild.

3-year investment period, the interest will be paid at the end of each year with 10% annual investment yeild.

4-year investment period, the interest will be paid at the end of each year with 11% annual investment yeild.

5-year investment period, the interest will be paid at the end of each year with 12% annual investment yeild.

The principal will be repaid when the investment period is due.

1-2. A one-time investment of SD $110,000 - SD $1,000,000

1-year investment period, the interest will be paid at maturity with 9% annual investment yeild.

2-year investment period, the interest will be paid at maturity with 10% annual investment yeild.

3-year investment period, the interest will be paid at maturity with 11% annual investment yeild.

4-year investment period, the interest will be paid at maturity with 12% annual investment yeild.

5-year investment period, the interest will be paid at maturity with 13% annual investment yeild.

The principal will be repaid when the investment period is due.

1-3. A one-time investment of SD $1,010,000 - SD $10,000,000

1-year investment period, the interest will be paid at maturity with 10% annual investment yeild.

2-year investment period, the interest will be paid at maturity with 11% annual investment yeild.

3-year investment period, the interest will be paid at maturity with 12% annual investment yeild.

4-year investment period, the interest will be paid at maturity with 13% annual investment yeild.

5-year investment period, the interest will be paid at maturity with 14% annual investment yeild.

The principal will be repaid when the investment period is due.

1-4. A one-time investment over SD $10,000,000

1-year investment period, the interest will be paid at maturity with 11% annual investment yeild.

2-year investment period, the interest will be paid at maturity with 12% annual investment yeild.

3-year investment period, the interest will be paid at maturity with 13% annual investment yeild.

4-year investment period, the interest will be paid at maturity with 14% annual investment yeild.

5-year investment period, the interest will be paid at maturity with 15% annual investment yeild.

The principal will be repaid when the investment period is due.

2.What is the Realty Fund Investment?

2-1. Why does the real estate development need to be financed by transferring the company's equity or by equity guarantee?

The real estate industry is a capital-intensive industry, which depends on capital to invest in real estate projects. Real estate developers generally raise money through the listing of the company or fund companies so that they can invest in more and larger real estate projects. Accordingly, they need to finance by transferring the company's equity or by equity guarantee.

2-2. Investment by Equity Transfer

According to the terms stipulated in the investment contract, the real estate developer can transfer the shares of the company to the investors, who owns shares of the company in proportion to the amount invested. After the completion of the project, the project profit shall be calculated when 95% of the house sales are achieved. The investor who is one of the shareholders of the company can be paid in dividends in accordance with the proportion of contribution. Generally, only investors or investment institutions with a one-time investment amount of more than USD $ 10,000,000 or SD $ 10,000,000 may choose this way of investment, that jointly undertake investment risks and share investment benefits with the actual proportion of contribution. This way is not suitable for small realty fund investors.

2-3. Fixed ROI of Realty Fund

The investors who typically invest USD or SD $10,000 - $10 million prefer a investment with a fixed ROI from the real estate developer. According to the terms stipulated in the investment contract, the investors owns shares of the company in proportion to the amount invested, but the shares can only be used as the guarantee of investment risks and can not participate in dividends. However, the developer can make an agreement in the investment contract that no matter the project is profitable or loss-making, the annual investment yield for the investors of realty fund must be fixed. This way is suitable for small realty fund investors.

3.Investors’ Equity Calculation Method in Asia SG Realty Fund

3-1. New Home Group 100% owns the parent company in Singapore and the parent company in the U.S.. The U.S parent company controls the projects in Los Angeles and Hawaii, and the Singapore parent company will control the real estate projects invested and developed in in Singapore and Malaysia.

For details, please visit: WWW.USAFW.COM

3-2. The project ALA MOANA HOME in Honolulu, Hawawii: total investment of USD $ 220 million, sales revenue of USD $ 320 million; pre-tax profit of USD $ 100 million. For more details, please visit: WWW.ALAMOANA-HOME.COM

3-3. The project ALA MOANA CONDO in Honolulu, Hawawii: total investment of USD $ 120 million, sales revenue of USD $ 170 million; pre-tax profit of USD $ 50 million. For more details, please visit: WWW.ALAMOANA-CONDO.COM

3-4. The project LA Valley Garden in Los Angeles, CA: total investment of USD $ 14 million, sales revenue of USD $ 20 million; pre-tax profit of USD $ 6 million. For more details, please visit: WWW.USAFW.COM

3-5. The above three projects are the main investment projects of our realty fund financing.

Total investment of above three projects: USD $ 220 million + USD $ 120 million + USD $ 14 million = USD $ 350 million

Total sales revenue (market value after completion) of above three projects: USD $320 million + USD $ 170 million + USD $ 20 million = USD $ 510 million

3-6. We will issue equity rights in realty funds for financing according to the total investment cost of USD $ 350 million of above three projects.

At present, we can issue maximum 50 million to 80 million shares.

3-7. Benefits for Singapore investors: For each SD $10,000 invested, USD $10,000 in shares will be transferred.

That is, SD $10,000 invested in New Home Group will own shares valued USD $ $10,000; SD $1 million invested in New Home Group will own shares valued USD $1 million.

3-8. Shares of the company owned by the investor can be transferred by agreement with our group.

4. Eligible Investors:

ELIGIBLE INDIVIDUAL CLIENTS MUST COMPLETE THE AI ELIGIBILITY FORM AND FULFIL ANY ONE OF THE BELOW CRITERIA:

Have an annual income in the preceding 12 months of not less than S$300,000 (or its equivalent in foreign currency), ORHave net financial assets (net of any related liabilities) exceeding S$1,000,000 (or its equivalent in foreign currency), OR

Have net personal assets exceeding S$2,000,000 (or its equivalent in foreign currency), of which net equity of the individual’s primary residence is no more than S$1,000,000.

5.Organization Structure of the Company:

5-1. NEW HOME GROUP, is a headquarter holding company.

5-2. The parent company in the United States and the parent company in Singapore control all the project companies.

5-3. The Singapore head office of our group owns all equity of the projects, enjoys the projects profits, and undertakes the responsibility of investment, financing, operation and managment of the projects.

ASIA SG REALTY FUND - Singapore

Cellphone:808 800 4999(Mr. FANG) Wechat:fang666666sg

Add.:27 NEW INDUSTRIAL ROAD, #01-01 NOVELTY TECHPOINT, Singapore 536212

ASIA SG REALTY FUND - Los Angeles

Cellphone:626 394 8582 (Miss CHEN)

Add.:1598 Long Beach Blvd, Long Beach, CA 90813, United States

ASIA SG REALTY FUND - ShangHai

Cellphone:13817888060 (Miss LIU)

If we do not answer your call, please leave a message, email or text us and we will contact you as soon as possible.

Contact: Johnson FANG

Cell: 808-800-4999

Add: 27 NEW INDUSTRIAL ROAD, #01-01 NOVELTY TECHPOINT, Singapore 536212